Medical Collections Coming Off Credit Reports!

Medical Collections are coming off your Credit Reports!! This is GREAT NEWS about medical collections! Starting July 1, 2022, a lot of medical collections are being removed from credit reports. This will help people have a better credit score. If you have medical collections holding your credit scores down you should start monitoring this. One

- Published in Mortgage News

Rob Miller ProVisor Home Loans – VA Minimum Property Requirements

MINIMUM PROPERTY REQUIREMENTS (MPR’s) FOR VA LOAN APPRAISALS REQUIREMENTS FOR ALL PROPERTIES Each living unit must have the space necessary to assure suitable living, sleeping, cooking and dining accommodations and sanitary facilities. Mechanical Systems must be safe to operate, be protected from destructive elements, have reasonable future utility, durability and economy and have adequate

- Published in Mortgage News

If You Really Love the House, Don’t Lose the Bid

In the housing market, the best deal doesn’t always come with the lowest price. Price vs. Payments: If you’re financing your purchase, you’ll probably never come close to paying the actual price. You’re making a comparatively small down payment and then paying interest on the loan until you refinance or sell. Yes, you will have

- Published in Mortgage News

You’ve served the US, now let us serve you!

Veteran’s Administration or “VA” loans are available for active, non-active, and retired Army, Air Force, Marine, Navy, National Guard, and Coast Guard vets who meet the established service requirements. The most notable features and benefits for those who qualify are: 100% financing/No down payment No monthly mortgage insurance (PMI) Gift funds acceptable for closing costs

- Published in Mortgage News

Mortgage Dos and Don’ts | ProVisor | Rob Miller

DO: Availability – Keep your financial records close at hand in case updates are requested. Income – Be aware that underwriters typically verify your income and tax documents through your employer, CPA, and/or IRS tax transcripts. Hold onto new pay stubs as received. Assets – Continue saving incoming account statements. Keep all numbered pages of

- Published in Mortgage News

Avoid Refinancing Traps | Rob Miller | ProVisor

The Automatic Payment Trap It can take up to two weeks to have automatic payments canceled. If your payments are made this way be sure to turn it off before closing. You don’t want to pay for the same month twice! The Missed or Late Payment Trap Believe it or not, lots of people think

- Published in Mortgage News

Ask The Expert | Rob Miller | ProVisor

The “Experts” Say… By ProVisor “Rates need to be 2% lower to justify refinancing.” Ever hear something like this and take it at face value? In the mortgage business, we hear recitals of old rules all the time. They often come from so-called experts, but frankly, there are times when their advice could lead you

- Published in Mortgage News

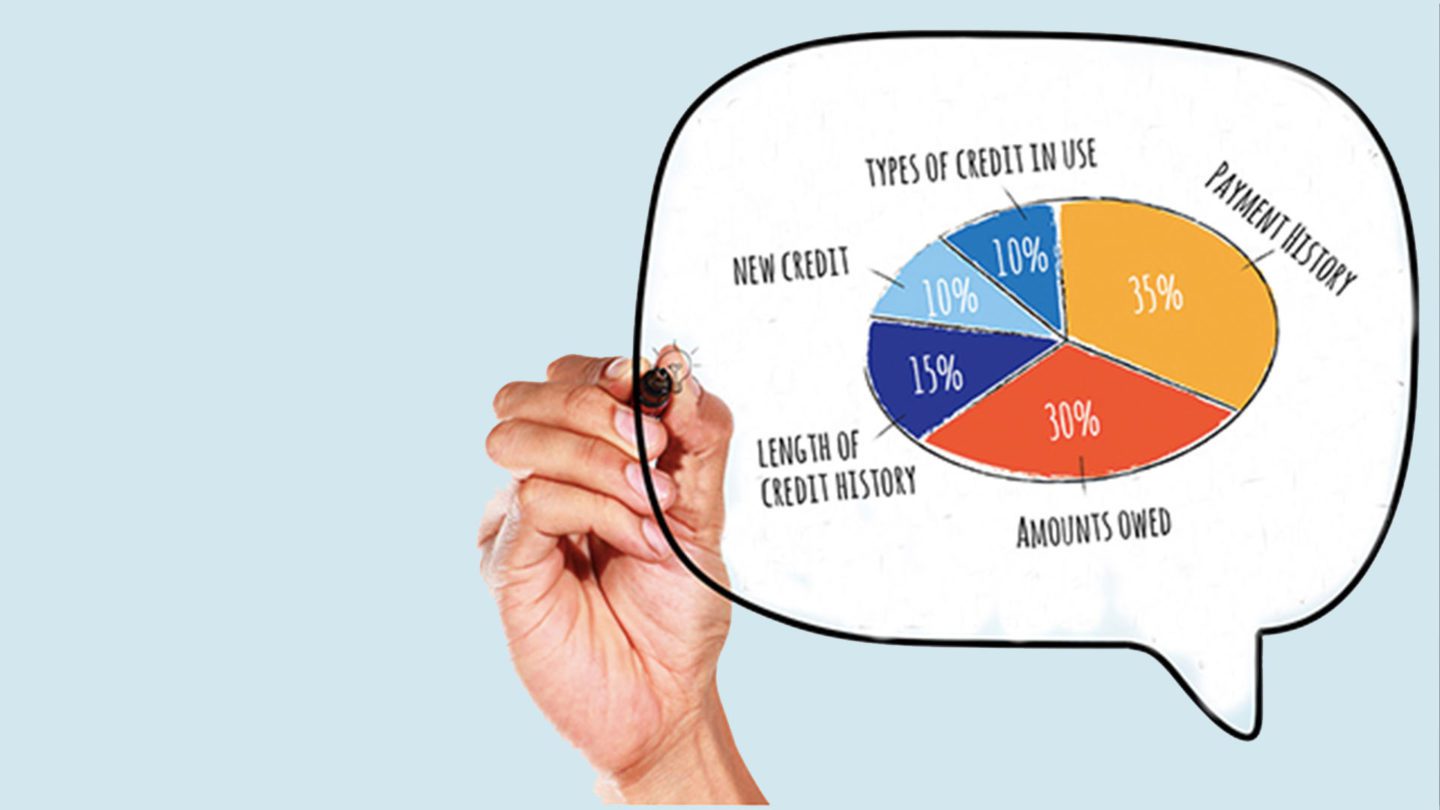

Credit Score | Rob Miller | ProVisor

Credit Score By ProVisor Understanding the makeup of your credit score is the first step toward managing and improving it. As you might expect, payment history is the most influential component in your credit score, followed closely by the amounts you owe. To lesser degrees, the length of time you’ve utilized credit, the number of new accounts

- Published in Mortgage News